Welcome to our new address

Lugogo One Building Plot 23 Lugogo Bypass, Kampala

Featured products

Forex

Are you traveling or sending money abroad? Are you concerned about counterfeit foreign exchange or…

Elite Banking

Your time is precious and that is why at BANK OF AFRICA, we let you…

SME Single Fee Banking Solutions

This account offers you reliability and certainty. No more unexpected charges, pay only once, and…

Instant Cash Salary Based Loans

Do you need credit to meet those unplanned expenses? Or do you need some quick…

Public Service Pack

Thank you for your effort in building this great nation through your service at the…

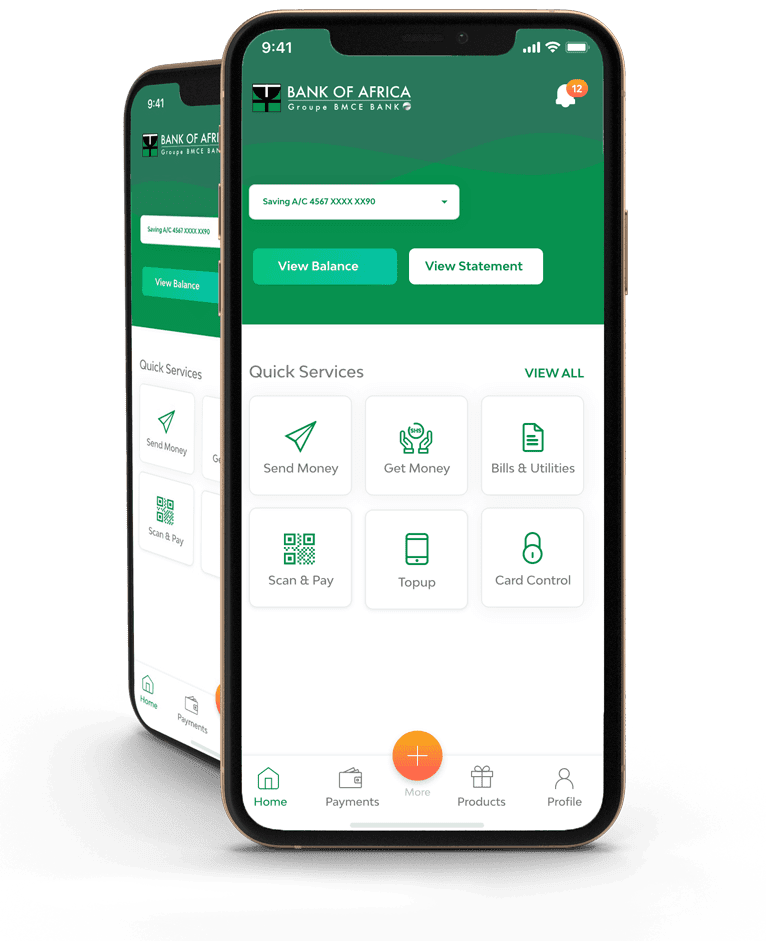

Internet Banking

Logon everywhere

Learn More